How to Invest in Battery Storage

In recent years, there has been a growing interest in investing in renewable energy sources and battery storage. As the world shifts towards a more sustainable and environmentally friendly future, the demand for battery storage solutions is on the rise. If you are looking to invest in this growing industry, here are some tips on how to do so.

Understanding the Market

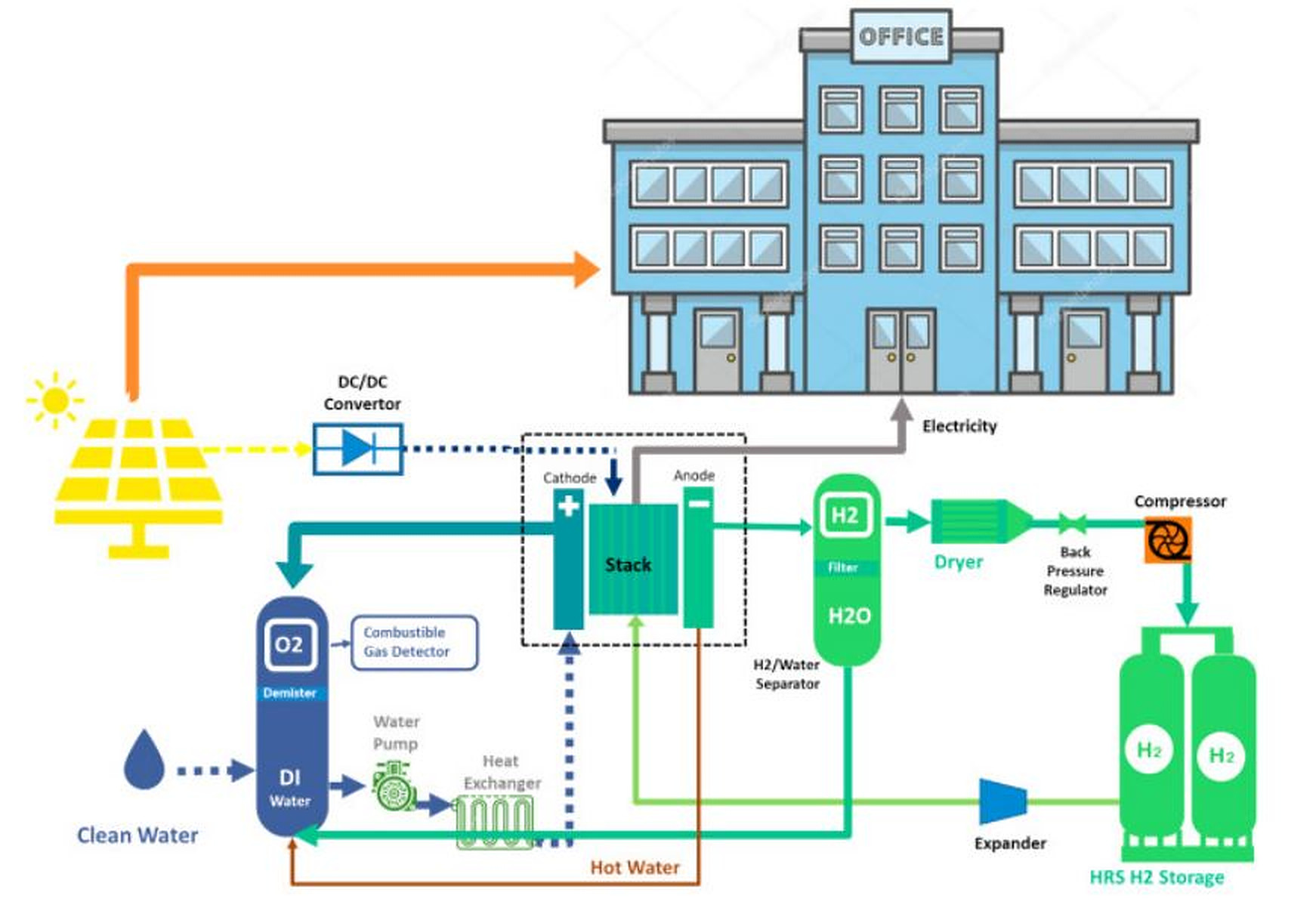

Before making any investment decisions, it’s important to understand the market for battery storage. Battery storage is an essential component of renewable energy systems, as it allows for the storage of energy when it is not immediately needed. This stored energy can then be used during peak demand periods or when renewable energy sources are not generating power. With the increasing adoption of solar and wind power, the demand for battery storage is expected to grow significantly in the coming years.

Research Potential Investment Opportunities

To invest in battery storage, you can start by researching potential investment opportunities in companies that are involved in the manufacturing, development, or deployment of battery storage solutions. Look for companies that have a strong track record in the industry and are poised for future growth. It’s also important to consider the technological advancements and innovations in battery storage, as these can significantly impact the success of your investment.Evaluate the Risks and Rewards

As with any investment, there are risks and rewards associated with investing in battery storage. It’s important to evaluate these factors before making any investment decisions. While the potential for growth in the battery storage industry is significant, there are also risks such as technological advancements, regulatory changes, and market competition. By carefully weighing the risks and rewards, you can make informed investment decisions.Diversifying Your Investment

When considering investing in battery storage, it’s important to diversify your investment portfolio. This can help mitigate risks and maximize potential returns. Consider investing in a mix of companies that are involved in different aspects of battery storage, such as manufacturing, research and development, and deployment. You can also explore investment opportunities in funds or exchange-traded funds (ETFs) that focus on the renewable energy and battery storage sectors.Seek Professional Advice

If you are new to investing or are unsure about the best approach to invest in battery storage, seeking professional advice can be beneficial. A financial advisor or investment consultant can provide valuable insights and guidance tailored to your investment goals and risk tolerance. They can also help you navigate the complexities of the battery storage market and identify the most promising investment opportunities.In conclusion, investing in battery storage presents an exciting opportunity to contribute to the growth of renewable energy and sustainable technologies. By understanding the market, researching potential investment opportunities, evaluating risks and rewards, diversifying your investment, and seeking professional advice, you can make informed decisions and position yourself for success in the growing battery storage industry.