The ACA Tax Credit for Battery Storage Systems

What is the ACA Tax Credit?

The ACA (Affordable Care Act) Tax Credit is a federal tax credit available to individuals and families who purchase health insurance through the Health Insurance Marketplace. The credit is designed to help make health insurance more affordable for those with low to moderate income.

How Does the ACA Tax Credit Apply to Battery Storage Systems?

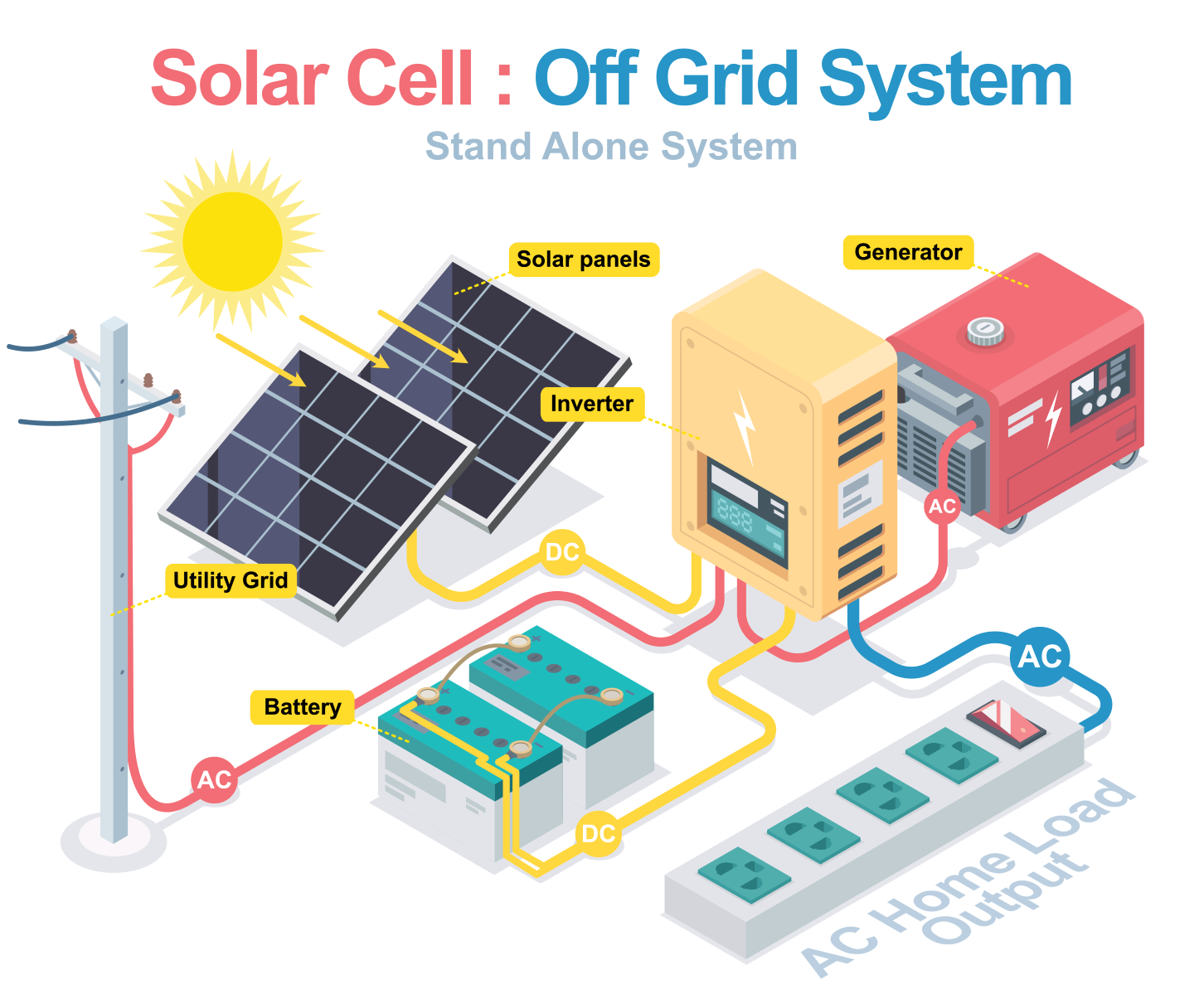

The Importance of Battery Storage Systems

Battery storage systems play a crucial role in the transition to clean and sustainable energy. These systems allow for the storage of excess renewable energy, such as solar or wind power, for use during times when the renewable energy source is not available. This helps to reduce the reliance on fossil fuels and promote a more environmentally friendly energy infrastructure.

The Incentive for Installing Battery Storage Systems

Under the ACA tax credit, homeowners and businesses that install battery storage systems as part of their renewable energy setup may be eligible for a tax credit. This incentive aims to encourage the adoption of renewable energy technologies and reduce the overall carbon footprint of the energy sector.

Eligibility for the ACA Tax Credit for Battery Storage Systems

Residential and Commercial Properties

The tax credit is available for both residential and commercial properties that install eligible battery storage systems. This means that homeowners and businesses can take advantage of the tax benefits associated with incorporating battery storage into their renewable energy solutions.

Requirements and Regulations

There are specific requirements and regulations that must be met in order to qualify for the ACA tax credit for battery storage systems. These may include the type and capacity of the storage system, as well as the integration with renewable energy sources. It is important for individuals and businesses to familiarize themselves with these requirements to ensure compliance and maximize the available tax benefits.

Consultation with Tax Professionals

Given the complexity of the tax credit and its application to battery storage systems, it is advisable for individuals and businesses to seek guidance from tax professionals. These professionals can provide valuable insight and assistance in navigating the eligibility criteria and maximizing the tax benefits associated with renewable energy investments.

Claiming the Tax Credit

Once the battery storage system is installed and meets the necessary criteria, individuals and businesses can claim the ACA tax credit on their federal tax return. This provides a direct financial incentive for investing in sustainable and eco-friendly energy solutions.

Continuous Support for Renewable Energy

The availability of the ACA tax credit for battery storage systems reflects the ongoing support for renewable energy initiatives at the federal level. By incentivizing the integration of battery storage with renewable energy sources, the government aims to drive the transition towards a more sustainable and environmentally conscious energy landscape.

Overall, the ACA tax credit presents a valuable opportunity for individuals and businesses to invest in battery storage systems as part of their renewable energy strategy while benefiting from important tax incentives. It serves as a testament to the commitment towards promoting clean energy solutions and reducing the environmental impact of traditional energy sources.