The tax benefits for photovoltaic systems are numerous and can provide significant financial advantages for both residential and commercial property owners. In this article, we will explore some of the key tax benefits associated with installing a photovoltaic system.

Federal Investment Tax Credit (ITC)

The Federal Investment Tax Credit (ITC) is one of the most significant tax incentives for photovoltaic systems. This credit allows residential and commercial property owners to deduct a percentage of the cost of their solar panel system from their federal taxes. As of 2021, the ITC allows for a credit of 26% of the total cost of the system, which can result in substantial savings for property owners.

Accelerated Depreciation

For commercial property owners, another valuable tax benefit associated with photovoltaic systems is accelerated depreciation. Under the Modified Accelerated Cost Recovery System (MACRS), commercial property owners can depreciate the value of their solar panel system over a shorter period of time, resulting in larger tax deductions in the early years of the system’s life.

State and Local Incentives

In addition to federal tax benefits, many states and local municipalities offer their own incentives for installing solar panel systems. These incentives can include additional tax credits, rebates, and grants that can further reduce the cost of installing a photovoltaic system.

Net Metering

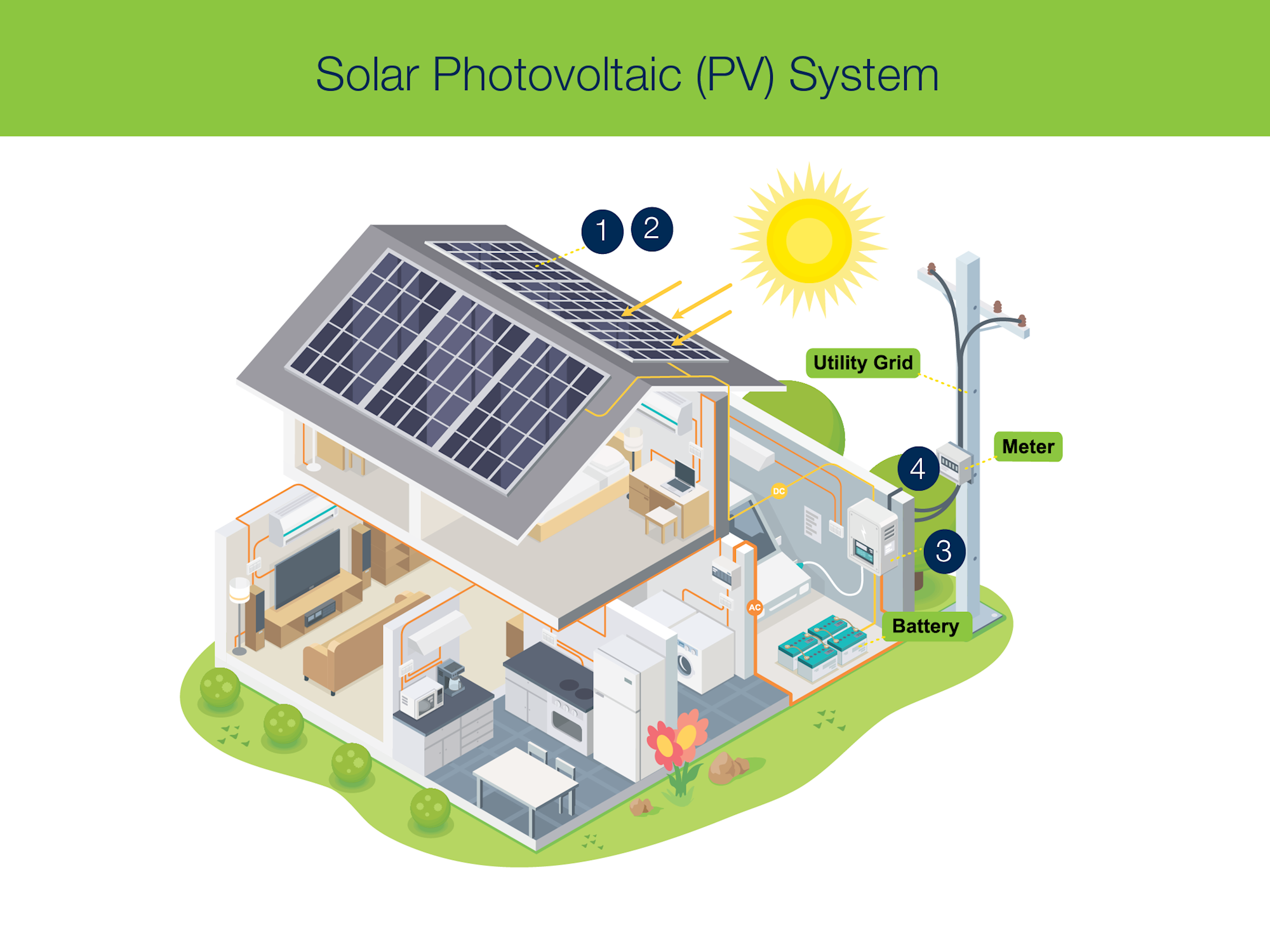

Many states also offer net metering programs, which allow property owners with solar panel systems to sell any excess electricity they generate back to the grid. This arrangement can result in significant savings on utility bills and may also provide additional financial benefits.

Property Tax Exemptions

Some states and localities offer property tax exemptions for the increased value of a property that comes from installing a solar panel system. This can result in long-term savings by reducing the property tax burden on the added value of the photovoltaic system.

Grant Programs

Various grant programs at the state and local level provide financial assistance to property owners looking to install solar panel systems. These grants can help offset the upfront costs of installing the system, making solar energy more accessible and affordable for a broader range of property owners.

Conclusion

Overall, the tax benefits for photovoltaic systems are numerous and can provide substantial financial advantages for property owners. From the Federal Investment Tax Credit to state and local incentives, there are a variety of ways for property owners to save money through the installation of a solar panel system. By taking advantage of these tax benefits, property owners can not only reduce their environmental impact but also enjoy significant cost savings over the life of their photovoltaic system.